|

Continued from

FrontPage of Article

Global consumer confidence sustained;

though consumers remain cautious about spending: ACNielsen

Singaporeans are upbeat about the

near future and local job prospects

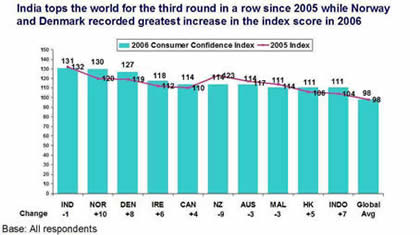

Global consumer confidence remains at

2005 levels, with Indians leading the world on the 2006 ACNielsen

Global Consumer Confidence Index followed by the Norwegians and

Danes. Singapore ranks 11th globally.

According to ACNielsen, the world¡¯s leading market research and

information company, the 2006 ACNielsen Global Consumer Confidence

Index of 98 is at par with the November 2005 Index.

India tops the world for the third time in a row since the Index was

established in early 2005, with an index of 131. Scandinavians made

their way into the top rankings as the world¡¯s second and third most

optimistic markets with Norway and Denmark hitting 130 and 127

respectively.

¡°Back home, Singaporeans registered an

increased level of optimism in this latest survey compared to the

previous period and a year ago. The Singapore Consumer Confidence

Index climbed 7 points to reach a high of 110¡ªsurpassing the

regional average of 94,¡± observed Mr Ashok Charan, Managing Director

of ACNielsen Research Singapore. ¡°It represents a year on year

improvement from May 2005 where Singapore¡¯s Consumer Confidence

Index was 99.¡±

¡¡

Asia Pacific continues to house the most optimistic consumers of all

with six of the Global Top 10 markets surveyed situated in the

region. Compared to the previous period, moreover, Hong Kong (111),

Indonesia (111), Singapore (110), and the Philippines (100) showed

strengthened optimism. In turn, New Zealand and Korea had the most

marked dip in confidence although New Zealand consumer sentiments

remain well above the regional average. Koreans continued to post

the lowest consumer confidence in the region (54).

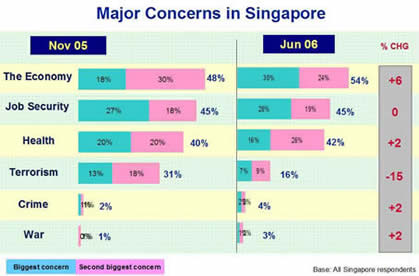

Major concerns

Despite a sustained level of confidence, consumers continue to cite

the Economy (47%), Health (37%), and Job Security (31%) as their

major concerns for the next six months. The Economy ranked highly in

Asia Pacific and drew greater attention in North America. Europeans

rank foremost in terms of concern for Health.

Led by Thailand (77%), Malaysia (71%), and Indonesia (70%), eight of

the 10 markets expressing the greatest concern for the Economy

originated from Asia Pacific.

In Singapore, the Economy (54%), Job Security (45%), and Health

(42%) continue to be the top three concerns amongst locals. With the

anxiety over Health and Terrorism receding over the last six months,

Singaporeans are now more focused on the Economy.

¡°Fundamentals such as the economy and

employment will remain as top concerns among locals even in good

times. Singaporeans¡¯ optimistic sentiment is set to continue, in

light of the positive economic growth in the first half and

favorable outlook reported by the government for the year,¡±

commented Mr Charan.

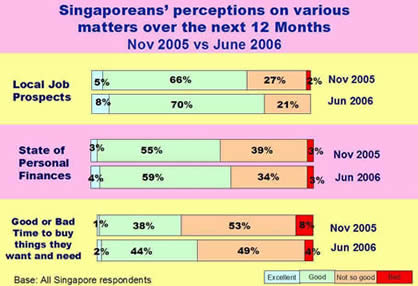

Perceptions on job prospects, personal finances, and intention to

spend

Reflecting the mildly positive mood in the region as a whole,

majority of the Asia Pacific markets have favorable expectations on

job prospects and on consumers¡¯ financial outlook over the next 12

months. Nonetheless, the region¡¯s consumers continue to adopt a

cautious stance on spending at the present time.

¡°It is only in India, where optimism has been strong over three

consecutive periods, that consumers voice clearer confidence about

spending,¡± said Mr Charan. ¡°The rest of the region¡¯s consumers may

be waiting for more sustained positive signals from the economy

before showing greater willingness to spend.¡±

In Singapore, locals have registered greater optimism in the recent

survey on all aspects¡ªjob prospects (+7%), personal finances (+6%),

and intention to spend (+7%), compared to six months ago.

It¡¯s worth mentioning that Asian markets of Singapore, Hong Kong and

Indonesia are among the most optimistic consumers during this round

of the survey.

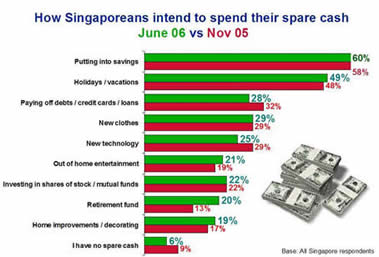

Asia

Pacific has the most savers in the world

Continuing the trend from previous surveys, the world¡¯s top savers

are still to be found in Asia Pacific. A majority of 54 percent of

Asia Pacific consumers will put their spare cash into savings,

compared to 37 percent of North Americans and 29 percent of

Europeans. Asian markets occupy every position in the ¡°Top Ten

Global Savers¡± list, with Thailand (70%) topping the global ranking

with the highest percentage of savers and a significant 15

percentage points increase compared to six months ago.

¡°Economic and cultural factors influence

Asians¡¯ penchant to save for a rainy day with levels higher than

other part of the world. With more than a third of consumers in Asia

Pacific concerned about job security, putting spare cash into

savings is certainly the safest financial option for consumers who

are insecure about their jobs,¡± said Mr Charan.

And how do consumers worldwide use their spare cash after covering

essential living expenses? Holidays/Vacations topped the list (34%),

followed by Out of Home Entertainment (33%), Paying off debts/credit

card bills/loans (32%), and Clothes shopping (31%).

While Asia Pacific consumers have consistently preferred

Holidays/Vacations (37%) as the way to indulge themselves,

priorities for other spending options have changed over time.

Consumers are now spending more on Out of Home Entertainment (30%)

and Clothes shopping (28%) over New Technology (24%) gadgets.

Amongst Singaporeans, the key priorities continue to be saving their

spare cash (60%), followed by spending on Holidays/Vacations (49%).

Next on the list are Clothes shopping (29%), Paying off debts/credit

card bills/loans (28%), and spending on New Technology gadgets

(25%).

The ACNielsen Online Consumer Confidence and Opinion Survey is the

largest half-yearly survey of its kind aiming at gauging current

confidence levels, spending habits/intentions and current major

concerns of consumers across the globe. The ACNielsen Consumer

Confidence Index is developed based on consumer¡¯s confidence in the

job market, status of their personal finance and their readiness to

spend. The latest survey, conducted in late May/early June, polled

about 21,780 internet users in 40 markets from Europe, Asia Pacific,

North America to the Baltics.

Markets Covered:

Australia (Aus), Austria (AT), Belgium (Bel), Canada (Can), Denmark

(Den), Finland (Fin), France (Fra), Germany (Ger), Greece (Gre),

Hong Kong (HK), India (Ind), Indonesia (Indo), Ireland (Ire), Italy

(Ita), Japan (Jpn), Korea (Kor), Malaysia (Mal), Netherlands (NL),

New Zealand (NZ), Norway (Nor), Philippines (PH), Poland (Pol),

Portugal (Por), Russia (Rus), Singapore (SG), South Africa (SA),

Spain (Spa), Sweden (Swe), Switzerland (Swi), Taiwan (TW), Thailand

(TH), Turkey (TR), United Kingdom (UK), United States (US),

Czechoslovakia (Cze), Hungary (Hun), Vietnam (Vnm) and the Baltics

(Bal) which covers Estonia, Latvia and Lithuania.

Click here to download the

full report.

Source:

http://sg.acnielsen.com Press

Release 4 Sep 2006

¡¡

|